July 2025 update on e-Invoice Requirements for Religious Organisations

e-Invoice engagement with religious bodies and organisations on 8th July 2025 at MOF Building, officiated by YB Lim Hui Ying 林慧英.

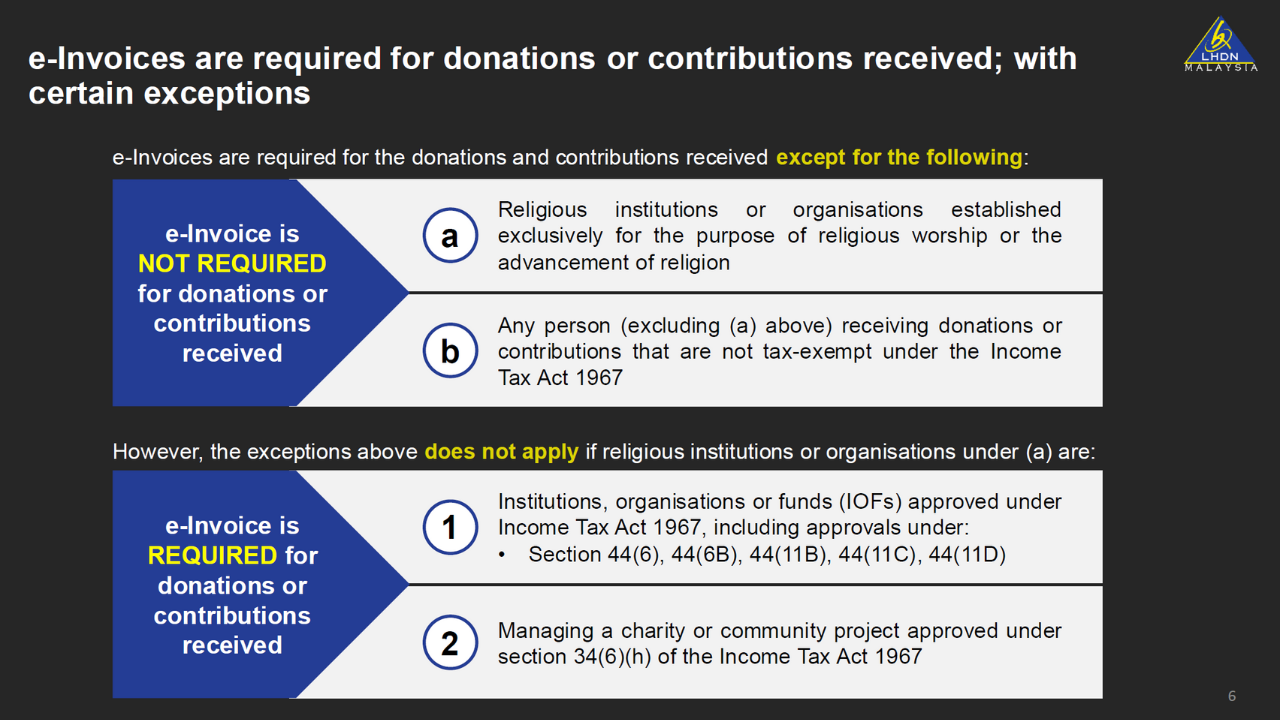

Religious organisations are not required to issue e-Invoices for donations or contributions, except in the following case:

* If the organisation has been granted income tax exemption under specific provisions of the Income Tax Act, such as Section 44(6) etc, then e-Invoices must be issued for donations and contributions received.

This means:

* Non-exempt religious bodies DO NOT need to issue e-Invoices for donations.

* Tax-exempt religious bodies (e.g., those that issue tax-deductible receipts under Section 44(6) etc) must comply with e-Invoice rules for such transactions.